Introduction

Picture this: You’ve just set sail on your offshore venture. The horizon looks promising, the market potential is vast, but the waters? Well, they’re unpredictable. Economic tides shift, regulatory storms brew, and currency fluctuations create unexpected waves. Now, the question is—can your financial forecasting weather these uncertainties, or will you be left stranded?

The High Stakes of Financial Forecasting

In offshore business, financial forecasting isn’t just about estimating numbers; it’s about survival. A miscalculation can mean the difference between profit and peril. Whether you’re expanding operations, seeking investors, or planning resource allocation, forecasting provides a compass to navigate your business toward profitability.

Why Financial Forecasting is Your Best Ally

Financial forecasting offers more than just projections—it equips you with insights to make informed decisions. Here’s why it’s crucial:

- Assessing Viability: Is your offshore venture sustainable in the long run?

- Strategic Planning: How can you prepare for market fluctuations and economic downturns?

- Risk Mitigation: Are you ready for worst-case scenarios?

- Investor Confidence: Can you present a clear financial roadmap that instills trust?

Strategies to Strengthen Financial Forecasting in Uncertain Markets

Uncertainty may be inevitable, but its impact on your financial projections doesn’t have to be. Here’s how you can reinforce your financial forecasting against volatile market conditions:

1. Scenario Planning: Expect the Unexpected

Think of your financial forecast as a choose-your-own-adventure book. You need multiple outcomes mapped out:

- Best-case scenario: What if market conditions are in your favor?

- Worst-case scenario: What if a global recession hits?

- Realistic scenario: What’s the most probable market condition in the near future?

Companies that use scenario planning improve forecasting accuracy by up to 30%.

2. Leverage Technology and AI

Gone are the days of manual spreadsheets and guesswork. Advanced financial forecasting tools powered by AI and data analytics can:

- Detect market trends in real time

- Automate complex calculations

- Identify risks before they escalate

- Improve forecasting accuracy by 20%

Fact: Companies integrating AI into their financial planning report a 15% reduction in financial discrepancies.

3. Maintain a Rolling Forecast

If your forecasting model is updated once a year, you’re already behind. Offshore markets move too fast for static projections. Instead, adopt rolling forecasts—continuous updates based on current data. This allows you to adjust financial strategies on the go, rather than waiting for annual reports to dictate your next move.

4. Cross-Functional Collaboration: Finance Isn’t an Island

Financial forecasting shouldn’t be isolated within the finance department. To gain a comprehensive view, businesses should foster collaboration between:

- Sales & Marketing (for revenue projections)

- Operations (for cost assessments)

- Supply Chain Management (for inventory and logistics insights)

Companies that integrate multiple departments into their forecasting process experience 25% fewer financial surprises.

5. Historical Data is Your Treasure Map

While past performance isn’t always a predictor of future results, it does provide valuable insights. By analyzing historical data trends, businesses can:

- Identify seasonal patterns

- Predict potential revenue fluctuations

- Determine cost structures

Fact: 80% of CFOs say that leveraging historical financial data has significantly improved their risk mitigation strategies.

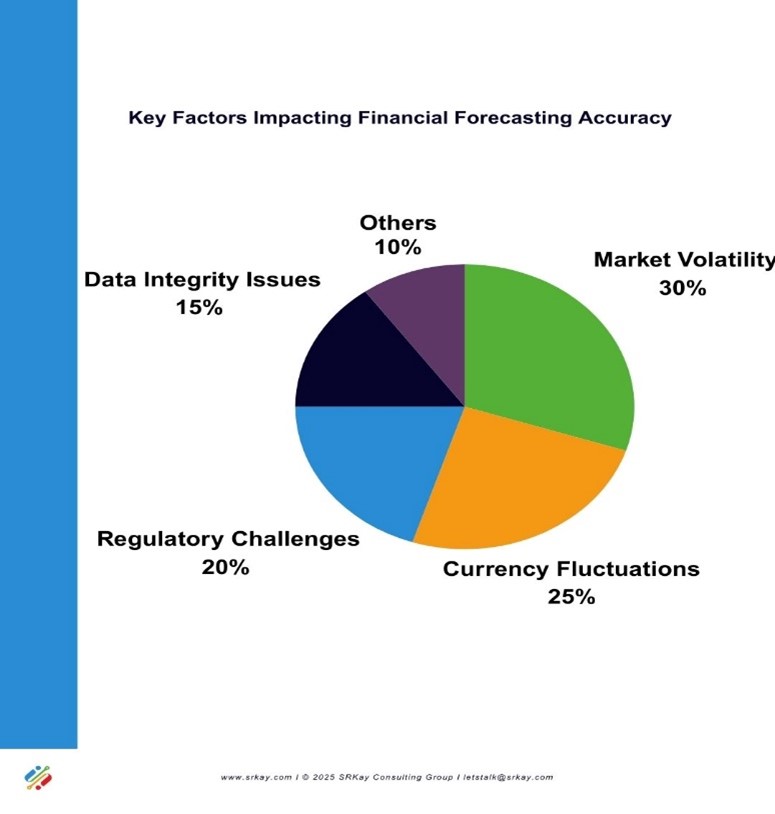

Challenges That Can Disrupt Your Forecasting Accuracy

Even with the best forecasting techniques, challenges persist. Some of the most common disruptors include:

1. Market Volatility

Economic and geopolitical events can cause sudden shifts in offshore markets. Brexit, trade wars, and fluctuating oil prices are all factors that can impact your financial projections.

2. Data Integrity Issues

Your forecasting is only as strong as the data feeding it. Poor data collection, outdated figures, or lack of integration between systems can lead to misleading projections.

3. Currency Fluctuations

If you operate in multiple countries, currency exchange rates can significantly impact your financial forecasts.

Businesses that implement currency hedging strategies see 40% lower financial volatility compared to those that don’t.

4. Regulatory Uncertainty

Changing tax policies, compliance requirements, and tariffs can all impact your financial health.

60% of companies expanding offshore struggle with tax compliance due to shifting regulations.

Turning Uncertainty into Opportunity

Here’s the silver lining: Uncertainty, while daunting, also presents opportunities. Businesses that master agile financial forecasting can turn unpredictability into a competitive advantage.

Seize the Moment with Smart Forecasting

Imagine being able to predict financial risks before they materialize. What if your company could proactively shift strategies instead of reacting to crises? That’s the power of advanced forecasting techniques.

By implementing:

- AI-driven forecasting tools

- Dynamic scenario planning

- Continuous data updates

- Cross-functional collaboration

…your offshore venture will not just survive uncertainties—it will thrive in them.

The Future of Financial Forecasting in Offshore Ventures

The future will always be uncertain, but your financial forecasting doesn’t have to be. Are you prepared to take control, or will you let unpredictable market forces dictate your fate?

The decision is yours.

But one thing is certain—if your offshore venture is built on smart financial forecasting, you’ll be sailing toward success, no matter how stormy the waters ahead may be.